- We expect retail mcommerce sales to account for 43.4% of total retail ecommerce sales in 2023, up from 41.8% in 2022.

- Consumers’ increased use of mobile devices to shop underscores the imperative for retailers and online marketplaces to create well-designed, easy-to-use experiences for both their mobile websites and apps.

- Do you work in the Ecommerce and Retail industry? Get business insights on the latest tech innovations, market trends, and your competitors with data-driven research.

Ecommerce has been on the rise massively in recent years, but it may not be the next true frontier for shopping as mcommerce continues to become more popular.

But just what is mcommerce, and how do we compare ecommerce vs. mcommerce?

Simply put, mcommerce involves shopping through a mobile device (typically a smartphone), while ecommerce involves shopping online through your computer.

And mcommerce is poised to burst into the mainstream thanks to a host of technological advances that are making it easier for users to shop on their phones. Below, we’ve outlined the road ahead for mcommerce growth and detailed some mobile shopping statistics.

Mobile Ecommerce Benefits

Mcommerce has the potential to become a major channel for shopping and to change consumer shopping habits. Consumers are reliant on digital devices now more than ever, and Insider Intelligence predicts that mobile will inch closer to becoming consumers’ preferred channel for online shopping within the next five years.

Social media sites such as Facebook, Twitter, and Pinterest have all introduced “buy buttons” that let shoppers make purchases without having to leave the platform. And many retailers have introduced one-click checkout to their sites. This method requires shoppers to enter their payment information once, and then they can use the one-click option to make purchases without having to re-enter it.

As app usage continues to grow, it will be a major contributor to sales growth, especially with Millennials and Gen Zers holding massive spending power. These tech-savvy users have the ability to boost volume, as they’re more likely to do a wider share of shopping on their smartphones.

Mcommerce Market Share and Size

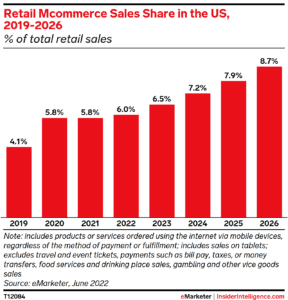

Despite leveling off following a pandemic bump, the mcommerce share of total retail will resume growing next year, reaching 8.7% by 2026, according to a June 2022 Insider intelligence forecast.

Mcommerce sales in 2022 will hit $415.93 billion—which represents 6.0% of total retail sales for the year. However, growth will fall below double digits for the first time, to 9.9%.

Mcommerce Statistics

Insider Intelligence predicts mcommerce sales to hit $534.18 billion, or 40.4% of ecommerce sales, in 2024. There are two key devices driving the mcommerce revolution: smartphones and tablets.

Seven years ago, mcommerce was fairly evenly split between tablets and smartphones, as conversion rates fell because of customer frustration from having to check out on a smaller screen. Today, smartphones now account for 87.2% of mcommerce sales; mcommerce trends are essentially synonymous with smartphone trends. The major difference is that smartphone commerce continues to grow slightly more quickly than mcommerce overall.

While tablets experienced a two-year resurgence, tablet commerce will not only lose share this year but will also lose absolute value of orders. Tablet mcommerce sales are expected to reach $54.01 billion by 2026, down from $61.08 in 2022.T his decline is likely due to to overall tablet use going down and the improvement of the mobile shopping experience.

Mcommerce Examples & Companies

As mobile wallets and contactless credit cards become increasingly popular, tech giants like Google and Apple are making their way to the forefront of the payments space.

Google Pay

Google recently revamped its Google Pay app for Android and iOS users, and includes checking and savings accounts in partnership with Citi and Stanford Federal Credit Union. The enhanced Google Pay app’s emphasis on money management tools could be a major customer acquisition advantage.

Amazon Pay

Buy buttons like Amazon Pay have built up user bases over the years. And Amazon Pay could be a precursor to the tech giant’s further moves in financial services, especially as it expands the wallet globally. As a mobile wallet and online buy button, Amazon Pay can be adapted to different markets and allow the firm to establish an audience around a payment tool.